To operate as a back-office support center,Į. Undertaking changes/modifications in the existing software/games,ĭ.

Undertaking design and development activities relating to software/games as per the defined prescription/criteria/details,ī. The basis for such cross charge/allocation shall be in compliance with the parameters laid down in Section 20 of the GST law to the extent possible.Ģ.1 The other GSTINs as referred to above renders the following business/back office support services in respect of service contracts entered and executed by directly head office with client/customers ():Ī. Turnover shall mean to be aggregate turnover as defined in GST law. NOW THEREFORE THE XYZ RECORDS MUTUAL UNDERSTANDING AS BELOW:ġ.1 The head office will allocate/cross-charge common expenses in respect of various procurements/inward supplies undertaken and executed at the head office for the business operations Illustrative list of such procurements/inward supplies are as follows ():ġ.2 Such allocation/cross-charge of common expenses shall be in compliance with the following conditions and processes: –Ī) That the framework would be worked upon on a quarterly basis.ī) The expenses will be allocated/cross charged by way of a tax invoice raised on other GSTINs containing the details prescribed in Rule 46 of the CGST Rules, 2017read with relevant State GST Rules, 2017 (hereinafter referred to as ‘GST law’).ġ.3 Such allocation/cross charge to all the other GSTINs shall be on a pro-rata turnover basis/headcount basis. In pursuance of the aforesaid, the XYZ herein wish to execute this Memorandum of Understanding (hereinafter referred to as ‘MoU’) cum hereinafter to as Business Arrangement Document (‘BAD’) to record the terms of their mutual understanding for the implementation of the above-referred frameworks in the best possible model which is in acquiescence with the GST law. Similarly, XYZ is also setting up a framework for invoicing/billing in respect of support services rendered by other GSTINs to the head office as mentioned supra (for the sake of ‘brevity’ referred to as ‘Framework 2’).Ĭ.

XYZ is setting up a framework of cross-charge/allocation of common expenses in respect of various procurements/inward supplies undertaken and executed at the head office for the business operations of other GSTINs as mentioned supra (for the sake of ‘brevity’ referred to as ‘Framework 1’).ī. Other GSTINs provide business/back office support services to the head office.įurther, XYZ executes/enters into contracts for various common procurements/inward supplies at the head office for the company as a whole (including for the business operations of other GSTINs).ĭetails of other GSTINs operating in different States of the company are as follows: GSTINĪ. No direct service or sales contracts with customers/clients are being executed from other GSTINs. XYZ follow centralised billing and accounting system and all the sales invoicing is done from head office. XYZ service contracts with client/customers are entered and executed from head office with GSTIN ………………. It is further relevant to note that supply of any service (including facilitation, arrangement, management) between the GSTINs inter-se operating under a single PAN are liable to GST in terms of Section 7 read with schedule I of the GST law even if there is no consideration. It is relevant to note that these GSTINs are treated as separate taxable persons for the purpose of GST law.

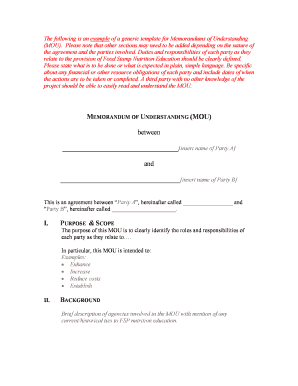

MOU DRAFT FORMAT REGISTRATION

(hereinafter to as ‘XYZ’ or ‘Company’) has multiple places of business across India and each such place of business (has a separate registration under Central Goods and Services Tax Act, 2017 and relevant State Goods and Services Tax Act, 2017 (hereinafter referred to as ‘GST law’). This Memorandum of Understanding (MoU) cum business arrangement document is drawn on the ……….

MEMORANDUM OF UNDERSTANDING CUM BUSINESS ARRANGEMENT DOCUMENT

0 kommentar(er)

0 kommentar(er)